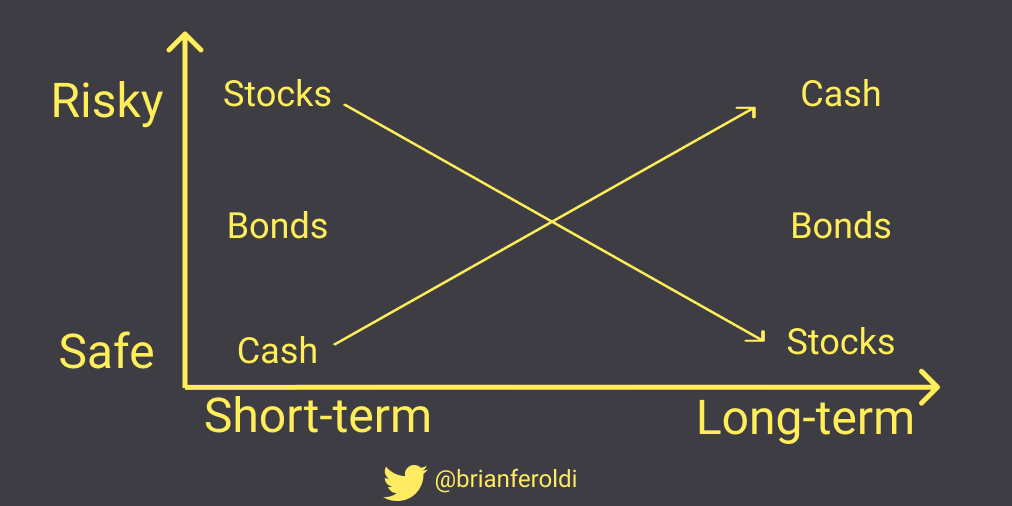

What's safe in the short term is risky in the long term

From a tweet by Brian Feroldi.

This chart illustrates a fundamental investment principle about how risk and safety can flip over different time horizons.

The Paradox:

- Cash appears safe short-term (no volatility, principal protected) but becomes risky long-term due to inflation eroding purchasing power

- Stocks appear risky short-term (high volatility, potential losses) but become safer long-term as they historically outpace inflation and compound growth takes effect

Why this happens:

Short-term perspective:

- Cash preserves nominal value - you won't lose money tomorrow

- Stocks can fluctuate dramatically day-to-day or year-to-year

- Bonds provide steady income with moderate price stability

Long-term perspective:

- Cash loses purchasing power to inflation over decades

- Stocks have historically delivered positive real returns over long periods (10+ years), despite short-term volatility

- The compounding effect of reinvested dividends and growth smooths out short-term market turbulence

Bonds sit in the middle - they're moderately risky short-term (interest rate sensitivity) and moderately safe long-term (but may not keep up with inflation as well as stocks).

This is why financial advisors often recommend younger investors hold more stocks (they have time to ride out volatility) while older investors near retirement hold more cash and bonds (they need stability and can't afford major losses).